Many consider life insurance to be a type of financial safety blanket that affords peace of mind. However, even in the face of this somewhat significant position in the scheme of financial schematics, many people still fail to recognize the use of life insurance. In this in-depth outline, we shall bring to light why life insurance is needed and highlight the types of life insurance currently offered, as well as explain how to choose the best policy for your needs.

1. Introduction to Life Insurance

Definition and Purpose

It is a contract between a person and an insurance company. In exchange for premium payments, the insurer undertakes to pay a certain sum upon death to a named beneficiary. The main objective of life insurance is to provide financial support for loved ones and to meet expenses arising on a person’s death.

Brief History

It has its roots in ancient times, where it was performed by burial societies and mutual aid associations of the time, providing financial support for those who died by paying for funerals and supporting the surviving dependents. Modern life insurance had its nucleus in the 17th century when the first insurance companies were created. The industry has since traversed through changing times and now offers a host of products catering to different needs.

Common Misconceptions about Life Insurance

Despite the advantages, It faces several misconceptions. People think it is for old age, those planning to retire, or those with a considerable estate to pass on. Others will think that it is very expensive or not necessary if one is healthy and young. The misperceptions bring about inadequate insurance or no insurance at all. Understanding the real purpose and benefits of life insurance is important in making informed decisions.

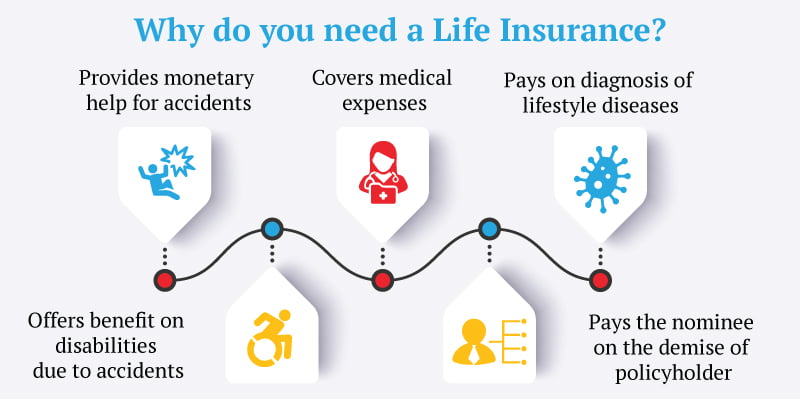

2. Why Life Insurance is Important

Financial Protection for Dependents

Arguably one of the key reasons to take out life insurance is to have adequate financial protection in place in case you are no longer there for your dependents. In such a case, you being the breadwinner in the family is bound to put the family in a financial crisis when it comes to paying for most daily utilities. In addition, life insurance provides the financial cushion to sustain their standard of living and meet basic expenses, such as housing, education, and health expenses.

Estate Planning

It can serve a very important role in estate planning. It can help pay estate taxes without having to sell the assets you worked hard to build, and it can provide liquidity to an estate in order to prevent a forced sale of your property.

Debt Coverage

Death does not absolve someone from his debts. Life insurance can replace lost income to pay off debts like your mortgage, car loans, credit cards, and so on. This way, you will not be passing these financial burdens down to your family, nor will they have the worry of trying to handle unpaid obligations.

Business Continuity

It can also literally be key to the continuation of a business. The death of a major person is usually disruptive and sometimes catastrophic in business. Life insurance may replace transition costs, lost income, or even facilitate the buyout of shares from a deceased partner.

Peace of Mind

Besides these practical, financial benefits, there is peace of mind. If you know that your loved ones will be taken care of in case something happens to you, then you will be free from stress and able to live fully. It is one proactive step taken toward securing your family’s future.

3. Types of Life Insurance

Term Life Insurance

Term life insurance offers protection for a definite period, most commonly 10, 20, or 30 years. It is straightforward and generally the most reasonably priced form of life insurance. If the policyholder dies within the term, the beneficiary can claim the death benefit. However, if he/she survives the term, there is no compensation, and coverage ends unless renewed.

Whole Life Insurance

It provides coverage over the lifeline of the policyholder, provided the premiums are paid. It also has an element of savings also called a cash value, which grows with time. One can borrow against this cash value or use this cash value to pay for premiums. A whole life insurance is expensive compared to term insurance, but it offers lifelong coverage and accumulation of cash value.

Universal Life Insurance

This is a flexible policy in the sense one will be able to get coverage for life with a saving element in it. The premium to be paid and the death benefit payable are flexible within certain limits that are defined. The cash value increases in keeping with interest rates declared by the insurer. This makes it more flexible compared to whole life insurance.

Variable Life Insurance

Variable life insurance takes the cash value and invests it in various investment avenues such as stocks, bonds, and mutual funds. The value may vary depending on the the performance of these investments. This brings both the possibility of higher returns with it, and increased risk of course.

Indexed Universal Life Insurance

Index universal life insurance is when the growth in cash value is linked to a stock market index, such as the S&P 500. This policy offers the benefits of universal life insurance with possible growth according to the performance of the market. This kind of policy balances flexibility and investment possibility.

4. How to Choose the Right Life Insurance Policy

Assessing Your Needs

Selecting the right life insurance policy should be based on one’s needs. Factors that one has to consider include the family’s financial status, existing debts, future financial goals, and the amount of cover that one may need. A financial advisor can help determine the right cover against a certain risk, considering one’s particular circumstances.

Understanding Policy Terms

It is very important to have a proper awareness of the different clauses of a life insurance policy before one actually buys it. This would pertain to coverage amount, premium payable, duration for which the policy is taken, and any kind of exclusions or limitations. Go through the policy document thoroughly and ask questions in case you don’t understand something properly.

Comparing Policies

While selecting a life insurance policy, check the alternatives available with other insurance companies. Compare the type of coverage, premium cost, features, and the insurance company’s reputation. Relief may also be available using online resources and brokers that can undertake a comparison of policies in order to arrive at the right solution for you.

Working with an Insurance Agent

Make your way to an experienced insurance agent to give you useful insight and advice about the right kind of policy you want. He will help you make your way around the life insurance and policy options, helping you to understand what kind of coverage you will be purchasing. Choose an agent who is reputable and strives to have your best interests at heart.

5. Cost Considerations

Factors Influencing Premiums

Life insurance premiums are determined by age, health, lifestyle, as well as the amount of coverage and associated underwriting risk. Generally, premiums for the young and healthy are relatively low. Other factors that may change the cost of premiums include lifestyle factors like smoking or hazardous leisure activities. Knowledge of these factors can enable informed decision of your cover.

How to Get Affordable Coverage

Looking for affordable life insurance means one should opt for term policy coverage since it is less expensive as opposed to whole life insurance. Additionally, living a healthy lifestyle can be a great way of reducing premiums. This involves keeping fit through exercise and avoiding smoking. One can also save on the cost of premiums by comparing quotes offered by various insurers.

The Role of Health in Premiums

Your health plays a significant role in your life insurance premiums. These are determined through medical examination and questionnaires. Pre-existing conditions or medical history raises the price of premiums, so having no such history of health problems lowers your rate. Good health and correcting any issues that may be present will bring down your premium.

6. Life Insurance and Major Life Events

Starting a Family

Starting a family is one of the most important times in your life to consider life insurance. Now that you are taking on the financial responsibility for raising children, you will want to make sure you are protected in case something happens to you. Based on family size and their financial requirements, evaluate the quantum of cover required.

Buying a Home

Responsible for significant debt, such as a mortgage, managing a home most of the time goes. Life insurance may offer protection from this debt by ensuring that, in the event of your death, your family can also keep up with the mortgage payments and stay in their house. You may want to adjust your coverage to befit your new financial responsibilities.

Retirement Planning

As your age increases and you near retirement, there might be a place for life insurance within the context of an overall financial strategy. It can help pay off debts that remain unpaid, provide for the golden years of your spouse, or can be left as a legacy for your heirs. One should always review the policy and make necessary adjustments to the coverage to suit the retirement goal.

Changing Careers

Career change may influence your financial condition and, therefore, your requirements regarding life insurance. If this new employment comes with other benefits or changes your level of income, review whether your life insurance policy still serves its purpose. It could mean updating your policy or picking a new one.

7. Common Mistakes and How to Avoid Them

Underestimating Coverage Needs

The most common mistake is underbuying. Hence, take an inventory of your current and future financial commitments. Your policy should have sufficient coverage for your family’s needs, debts, and other financial responsibilities.

Ignoring Policy Reviews

You could end up having inadequate insurance cover if you do not review your life insurance policy at periodic intervals in cover. Circumstances of life are subject to change with time, and so should your policy. Review it regularly to be relevant to your situation at that time and make necessary amendments.

Not Updating Beneficiaries

Not updating beneficiaries can lead to unintended consequences. Make sure your beneficiary designations are current and reflect your wishes of the day. This includes updating your beneficiaries at major life-changing events, such as when you get married or divorced and when a child is born.

Misunderstanding Policy Details

One may get unpleasant surprises regarding policy details in a case it is not rightly understood, especially at times when the coverage is needed most. Take time to study your policy’s contents: terms, conditions, and exclusions. In case of questions, seek clarification from your insurance agent so as not to encounter problems.

8. Conclusion

Recap of Key Points

Life insurance forms an important part in a proper financial plan. It provides financial security to dependents, facilitates estate planning, repays debts, and allows for business continuity. In this context, it is essential to know the types of life insurance policies available in the market and how to choose a policy that addresses needs adequately.

Final Thoughts on Life Insurance

Insure your life to help safeguard the future of your family. By checking your needs, comparing policies, and understanding what affects premiums, you are better placed to have peace of mind and financial security through informed decisions. Let myths or procrastination not deprive you of the cover your loved ones need. Life insurance is not a product like any other financial instrument; rather, it’s some sort of assurance for your family members that you will always look out for them in terms of care and protection.

This guide will help you understand why you need life insurance and will serve as your roadmap to the best possible decisions that concern your situation. Life insurance is part of responsible planning on your financial matters, not just a policy, and it will be a testimony to the love you have towards your family for providing for them even in death.

Pingback: Life Insurance for the Disabled: A Complete Guide